how are property taxes calculated in fl

Be careful to get the right district and rate. That seems very low.

What Is A Homestead Exemption And How Does It Work Lendingtree

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected.

. Taxable Value X Millage Rate Total Tax Liability. Add the value of the land and any improvements to determine the. This simple equation illustrates how to calculate your property taxes.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. What will my taxes be.

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. Floridas property tax system county property appraisers assess all real property in their counties as of january 1 each year. The tax certificate sale must be held 60 days after the date of delinquency or June 1 whichever is later per Florida Statute 197402.

Assessed Value - Exemptions Taxable Value. With each subsequent annual assessment your. Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value.

Property taxes make up a portion of your monthly mortgage payment and based on the size and condition of your home they may represent anywhere from a few hundred to a few thousand dollars. Mandarin Chinese Restaurant Lahore. A number of different authorities including counties municipalities school boards and special districts can levy these taxes.

Florida real property tax rates are implemented in millage rates which is 110 of a percent. How Are Property Taxes Calculated In Polk County Florida. Restaurants In Erie County Lawsuit.

How Are Property Taxes Calculated In Polk County Florida. The median property tax on a 21060000 house is 204282 in florida. JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value.

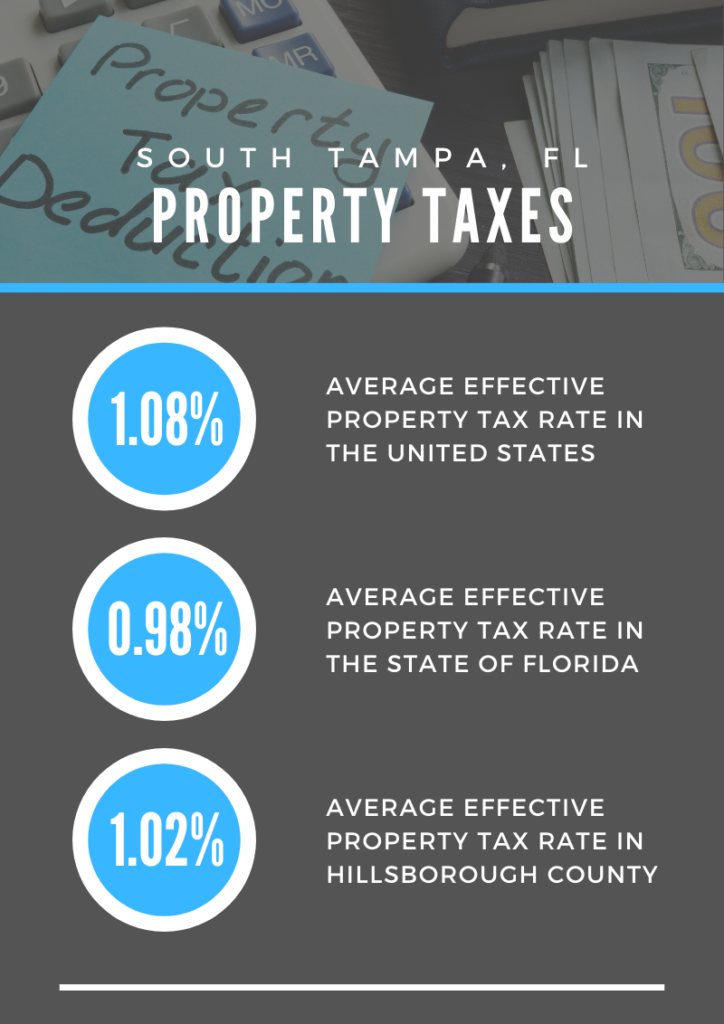

I was also told by a real estate agent that its somewhere between 15. The median property tax on a 19890000 house is 216801 in Hillsborough County. As you create a budget and save up to buy a home in South Florida its important to estimate every cost and fee youll have to pay.

These are fees for specific services. Homeowners in Durham County pay some of the highest property taxes in the state. February 13 2022.

Non Ad Valorem Taxes. Sales Tax Reno Nv 2021. Just Value - Assessment Limits Assessed Value.

The median property tax on a 19890000 house is 192933 in Florida. The median property tax on a 21060000 house is 219024 in lee county. The median property tax in Florida is 097 of a propertys assesed fair market value as property tax per year.

The basic formula is. See the Tax Estimator page. Are Dental Implants Tax Deductible In.

The median property tax on a 19890000 house is 208845 in the United States. Tax amount varies by county. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected.

Palm Beach County Tax Collector Attn. I am confused as to how the property taxes are calculated in Florida. It is important to realize that taxes are a year behind in our declining market.

How are property taxes calculated in lee county florida. To calculate the property tax use the following steps. The countys average effective property tax rate is 118 which comes in as the fourth-highest rate of any North Carolina county.

Beginning with the first year after you receive a homestead exemption when you purchase property in Florida an appraiser determines the propertys just value. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. Florida Paycheck Calculator Smartasset.

So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. This equates to 1. The median property tax on a 18240000 house is 176928 in Florida.

The median property tax on a 18240000 house is 191520 in the United States. Floridas median income is 53595 per year so the median yearly property tax paid by Florida residents amounts to. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

Dinner Restaurants Near Me Reservations. For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of. Online calculators have put property taxes across Florida under 1.

County property appraisers assess all. Italian Restaurants Milwaukee Area. This western North Carolina County has property tax rates.

The Constitutional Tax Collector is required by law to hold an annual tax certificate sale to collect the preceding years unpaid taxes and associated fees. Restaurants In Matthews Nc That Deliver. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in.

Find the assessed value of the property being taxed. When it comes to real estate property taxes are almost always based on the value of the land. Opry Mills Breakfast Restaurants.

Taxes are assessed a year behind current market values. I know the taxes vary by county. Property taxes in Florida are implemented in millage rates.

Property taxes are determined by multiplying the propertys taxable value by the millage rate set each year by the taxing authorities. If I was to buy a 250k condo in Palm Beach county what would my property taxes be. The best thing to do is to go to the tax estimator page of the Marion County Property Appraiser.

Dunedin Again Holds The Line On Property Tax Rate North County Tbnweekly Com

Property Taxes How Much Are They In Different States Across The Us

Real Estate Taxes City Of Palm Coast Florida

Florida Property Tax H R Block

Property Taxes Calculating State Differences How To Pay

How To Calculate Property Tax And How To Estimate Property Taxes

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Boxes Easy

Property Tax Prorations Case Escrow

Real Estate Property Tax Constitutional Tax Collector

Florida Property Taxes Explained

A Guide To Your Property Tax Bill Alachua County Tax Collector

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

What Is Florida County Tangible Personal Property Tax

Property Tax How To Calculate Local Considerations